News

Our fund services team has decades of experience and a proven track record administering both closed and open-ended funds established in Jersey, US, UK, Guernsey, Ireland, Luxembourg, Cayman Islands, South Africa, Mauritius and BVI.

Focused on the provision of bespoke administration services, our corporate team supports clients that range from small and medium sized enterprises to multinational companies including NYSE, FTSE and Euronext traded companies.

JTC Private Client Services specialises in protecting and nurturing your private capital in real estate, financial and non-financial assets across countries and generations.

JTC Private Office offers a holistic service built around the unique needs of your family. Working in partnership as an extension of your family, we create time for you by bringing simplicity, clarity and flexibility to the management of your financial and non-financial affairs.

The economic conditions faced by the large clients we serve globally are always changing. Our experienced and skilled teams are uniquely positioned to deliver bespoke transformative solutions to address the challenges and seize the opportunities clients are facing, in order to help them achieve their ambitions and goals.

" It is rare to find offshore advisers that not only understand the importance of compliance but also have the capacity and take an interest in understanding clients’ personal requirements. "

UHNW Professional Adviser

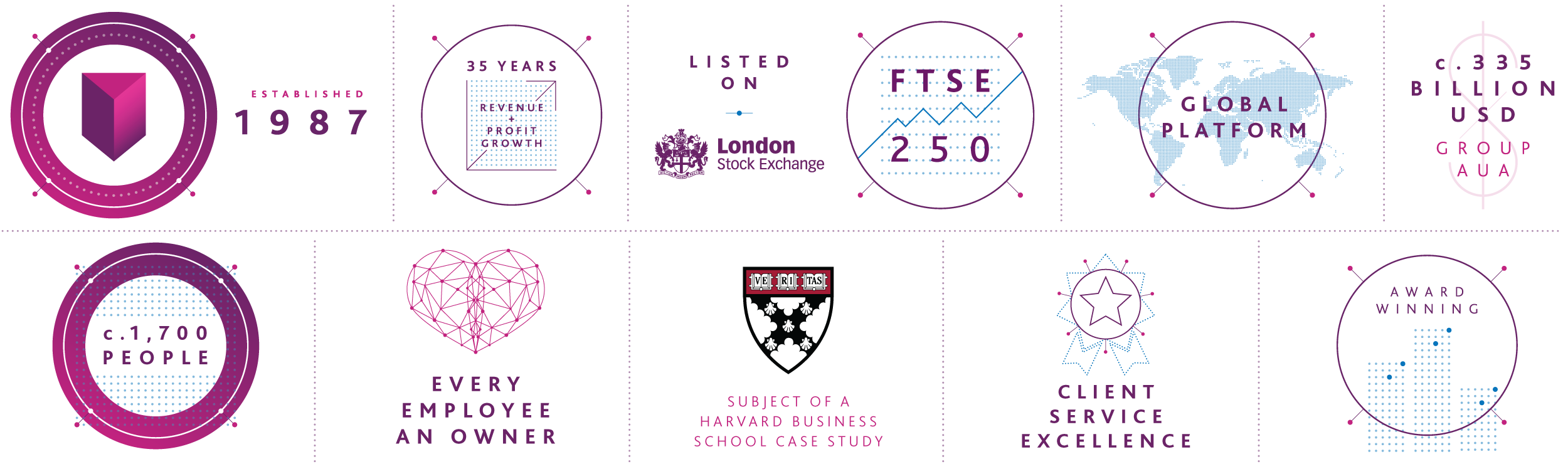

We operate around the principle that if our people have a stake in the business, they will do a better job for our clients.

Over 83% of our employees hold a relevant professional qualification or are working towards this through our dedicated JTC Academy.

We operate a variety of best-in-class systems to deliver and maintain an impeccable standard of administration and use technology to innovate in both service delivery and efficiency.

We aim to work with clients who share our belief in the importance of building strong relationships over time.

Please use this short form to help us respond to your enquiry as efficiently as possible.